Giving back to your community is always a rewarding experience, but did you know that charitable donations can also substantially reduce your tax burden? By giving to qualified nonprofit organizations, you can possibly lower your taxable income and minimize your overall get tax free savings for charity tax owed. Discover the various tax benefits available to donors and strategize your giving to maximize your impact both financially and socially.

- Consider the types of charitable contributions that most effectively suit your financial situation.

- Preserve accurate records of all donations, including receipts and donation documents.

- Discuss with a qualified tax professional to comprehend the specific tax implications of your charitable giving.

Give Back & Get Tax Benefits: Donate Today

Do you want to make a positive impact on the world while also enjoying some financial perks? Perhaps consider making a donation to your favorite nonprofit. Your generous contribution can directly help those in need and provide you with valuable tax benefits. By donating today, you can minimize your taxable income and earn a substantial deduction on your taxes.

- That's a win-win situation!

- Join in making a difference and enjoy the monetary rewards of giving back.

Don't wait, commence your donation journey today! Your contribution can make a world of impact.

Strategic Charitable Contributions Reduce Your Taxes Through Donations

Are you considering ways to minimize your tax liability? Smart giving can be a powerful strategy. By making to qualified charities, you can claim charitable donations on your taxes, potentially reducing your tax amount. To maximize the benefits of smart giving, speak with a financial advisor to evaluate the strategies that suitably align with your personal circumstances.

- Research charities carefully to ensure they are qualified by the IRS.

- Maintain detailed records of all donations, including dates, amounts, and recipient information.

- Evaluate various donation methods, such as cash, stock, or in-kind contributions.

Smart giving is a mutually beneficial situation. You can make a impactful difference in the world while also lowering your tax burden.

Contribute to a Cause and Save on Taxes

Charitable giving is a wonderful way to impact your community. But did you know that your generous donations can also provide financial benefits? When you support a qualified 501(c)(3) organization, you may be eligible for valuable tax deductions. This means you can lower the amount of taxes owed while simultaneously supporting a cause you care about deeply.

To ensure your donations are tax-deductible, it's important to track your contributions carefully. Seek guidance from a tax professional to maximize your savings. By combining charitable giving with smart financial planning, you can create a win-win situation that benefits both you and the causes you support{. By making a difference in the world while also saving money, you can truly make an impact.

Charitable Contributions: A Win-Win for You and Charity

Making gifts is a wonderful way to impact the world. Not only does your generosity support vital resources for those in need, but it also offers personal fulfillment to you. When contributing to a cause you care about, you become a part of the solution in your society.

- Your donations can help provide

- food and shelter to those experiencing homelessness

- Fund research for life-saving medications

- Provide scholarships for

Ultimately, volunteering is a mutually beneficial transaction. You contribute to the betterment of society, and in doing so, you enrich your own life.

|Decrease Your Tax Liability While Helping Others

Smart tax planning helps you keep more of what you earn. It also provides an excellent avenue to support the causes you believe in. By choosing wise philanthropic investments, you can lower your tax bill while making a real difference.

Explore these options::

- Transferring valuable items

- {Taking advantage of tax credits|Leveraging available tax breaks

- {Setting up a donor-advised fund|Establishing a philanthropic vehicle

With some careful consideration, you can give back to your community and save on taxes. {Consult with a qualified financial advisor or tax professional|Speak to a certified public accountant (CPA) to find personalized solutions.

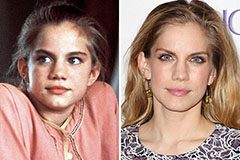

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now!